Mutual Funds 101: A Beginner’s Guide to Smart Investing

Investing can seem daunting, especially if you're just starting out. One of the most accessible and effective ways to begin your investment journey is through mutual funds. If you're new to investing, here's a simple guide to understanding mutual funds and how they can help you grow your wealth.

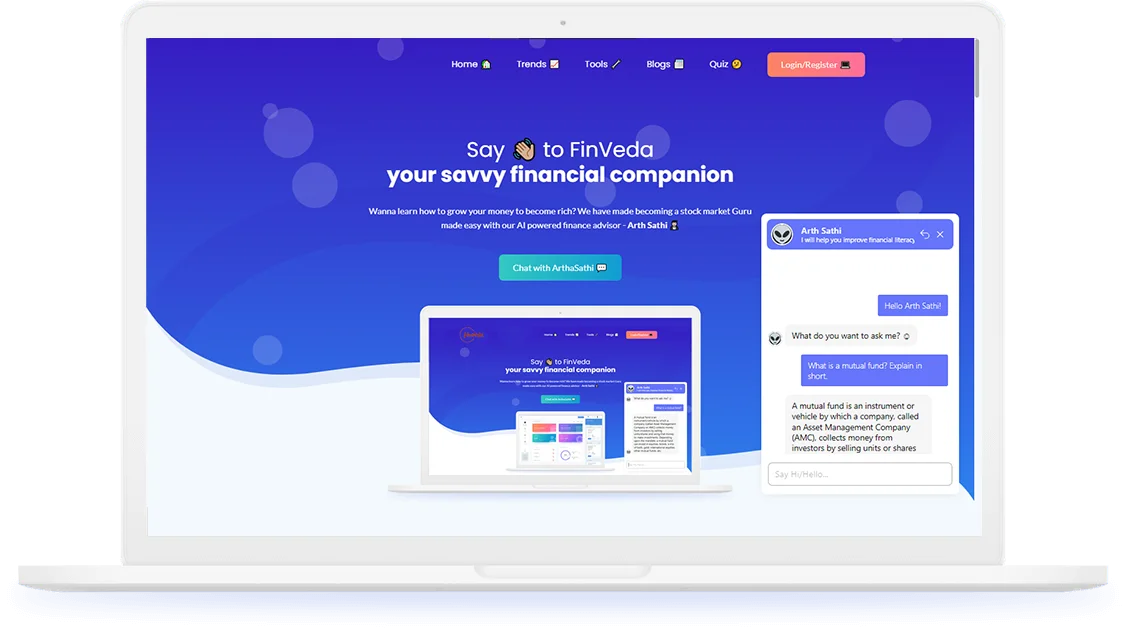

What is a Mutual Fund?

A mutual fund is a pool of money collected from many investors to invest in a diversified portfolio of stocks, bonds, or other securities. Professional fund managers handle the investment decisions and daily operations, aiming to achieve specific financial goals for the fund's investors.

How Do Mutual Funds Work?

Types of Mutual Funds

Benefits of Investing in Mutual Funds

Getting Started with Mutual Funds

To start investing in mutual funds, follow these steps:

- Determine Your Investment Goals: Define what you want to achieve, whether it’s saving for retirement, a child's education, or another financial goal.

- Assess Your Risk Tolerance: Consider how comfortable you are with the possibility of losing money in exchange for potential higher returns.

- Choose a Fund: Research different mutual funds to find one that aligns with your goals and risk tolerance. Look at factors such as the fund's performance history, fees, and the experience of its managers.

- Open an Account: You can invest in mutual funds through a brokerage account or directly with the fund company. Fill out the necessary paperwork and make your initial investment.

- Monitor Your Investment: Regularly review your mutual fund’s performance and make adjustments if necessary to stay on track with your goals.

Conclusion

Mutual funds can be a great way to begin investing, offering diversification, professional management, and ease of access. By understanding the basics and selecting the right funds for your financial goals, you can start building a solid investment foundation. Remember to keep learning and stay informed about your investments to make the most of your mutual fund experience.

Happy investing!